Table Of Content

Unless you qualify for an exemption, you’ll owe at least something for this type of asset. Second, there are a few places where the rate jumps — notably from 12% to 24% and then 24% to 32%. If you have a net capital gain, a lower tax rate may apply to the gain than the tax rate that applies to your ordinary income. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. The term "net long-term capital gain" means long-term capital gains reduced by long-term capital losses including any unused long-term capital loss carried over from previous years.

What about a partial home exclusion?

Your capital gains tax rate will depend on your current income tax bracket, the length of time you’ve held the asset and whether the property was your primary residence. A short-term capital gain is the result of selling a capital asset you held in your possession for one year or less. Long-term capital gains are capital assets held for more than a year. Typically, you pay a higher tax rate on short-term capital holdings versus long-term ones.

2023-2024 Long-Term Capital Gains Tax Rates - Bankrate.com

2023-2024 Long-Term Capital Gains Tax Rates.

Posted: Wed, 13 Mar 2024 07:00:00 GMT [source]

Reporting Home Sale Proceeds to the IRS

You may use the Capital Loss Carryover Worksheet found in Publication 550 or in the Instructions for Schedule D (Form 1040)PDF to figure the amount you can carry forward. To correctly arrive at your net capital gain or loss, capital gains and losses are classified as long-term or short-term. Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term.

What’s my capital gains tax rate?

Rayner has said she will “do the right thing and step down” if she is found to have committed a crime but remains confident she has followed the law at all times. Legal and financial information, such as the address on her payslips, are understood to be relevant to the inquiry. It comes after The Times revealed that Rayner’s tax affairs and other issues would form part of the police inquiry, which is expected to take weeks and is likely to overshadow the forthcoming local elections. Greater Manchester police is also examining allegations that she supplied incorrect information to the electoral register when she lived between two houses in Stockport in the 2010s. In a previous statement, Ms Rayner said she was “completely confident” that she had followed the rules at all times but said she would resign if she was found to have committed a criminal offence. Documents seen by The Telegraph also show that Mr Rayner purchased his property in 1991 for a price of £11,000 through the right to buy scheme, which gave him a discount of £16,800.

To abandon a security, you must permanently surrender and relinquish all rights in the security and receive no consideration in exchange for it. If you decide to go the QOF route, you must elect the tax deferral on your tax return for the year of the sale. Follow the instructions on Form 8949 for electing deferral and reporting the deferred gain and submit Form 8949 with your return. Some financially distressed homeowners might be considering a short sale of their home. A short sale occurs when your mortgage lender agrees to accept less than the outstanding balance on your loan to help facilitate a quick sale of the property.

What to know about capital gains tax on a house sale - Los Angeles Times

What to know about capital gains tax on a house sale.

Posted: Sun, 14 Jan 2024 08:00:00 GMT [source]

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. If you plan to sell a rental property you’ve owned for less than a year, try to stretch ownership out to at least 12 months, or your profit will be taxed as ordinary income. The IRS doesn’t have a ceiling for short-term capital gains taxes, and you may be hit with up to 37 percent tax. Let's say that your cost basis in a duplex is $250,000 and that you've owned it for 10 years. Over the 10-year ownership period, you've claimed a total of $90,900 in depreciation expense.

Long-Term Capital Gains Taxes

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Saskatoon Public Schools says budget increase won't cover growing enrollment or class complexity

Report this amount on Schedule 1 (Form 1040), line 8z, or Schedule NEC (Form 1040-NR) if a nonresident alien. The selling price of your home doesn’t include amounts you received for personal property sold with your home. The real estate tax on Jackie and Pat White's home was $620 for the year. Their real property tax year was the calendar year, with payment due August 3, 2023.

It's also about understanding and navigating the tax implications to ensure you're not unnecessarily parting with your hard-earned money. The aim is to minimize your tax exposure by carefully planning your sale and leveraging any applicable tax strategies. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. We are an independent, advertising-supported comparison service.

However, The Times has been told she has been advised that even if it was not her principal residence an “enhancement exemption” writing off the capital gains could be applied because of significant renovations. Before you can calculate the capital gains taxes on the sale of your home, you must first understand basis. For a complete understanding and a full review of your specific situation, contact an Orange County Estate Planning Attorney at Modern Wealth Law. You recapture the benefit by increasing your federal income tax for the year of the sale.

You can't claim the exclusion if you already took it for another home in the two-year period before the sale of this home. With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

If you’re selling your primary residence, you may be able to avoid paying the capital gains tax on the first $250,000 gain if you’re a single tax filer and $500,000 for married couples filing jointly. However, if you’ve owned your home for at least two years and meet the principal residence rules, you may be able to exclude some or all of the long-term capital gains tax that would be owed on the profit. Single people can exclude up to $250,000 of the gain, and married people filing a joint return can exclude up to $500,000 of the gain. Tax-loss harvesting is a strategy that allows investors to avoid paying capital gains taxes.

Deferrals of capital gains tax are allowed for investment properties under the 1031 exchange if the proceeds from the sale are used to purchase a like-kind investment. Capital losses incurred in the tax year can be used to offset capital gains from the sale of investment properties. So, although not afforded the capital gains exclusion, there are ways to reduce or eliminate taxes on capital gains for investment properties. The main proposal, which lends context to the above-mentioned “separate proposal,” is to raise the long-term capital gains and qualified dividends rates to 37% for taxpayers with taxable income above $1 million. Potential Impact Raising the capital gains tax rate could have several effects on the economy and financial markets.

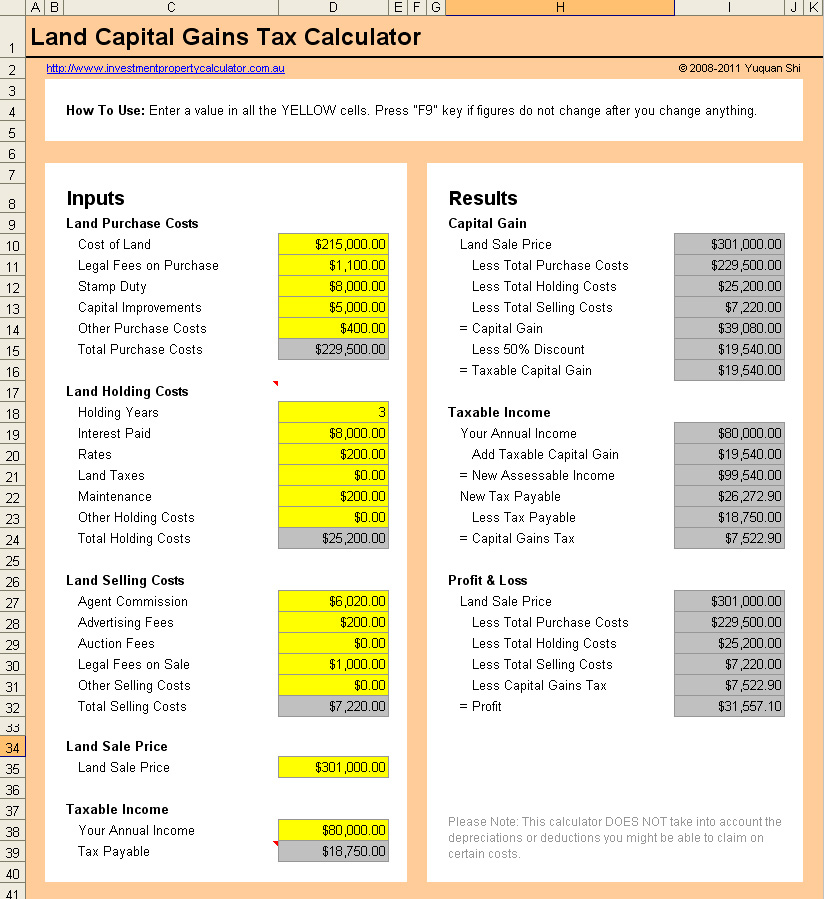

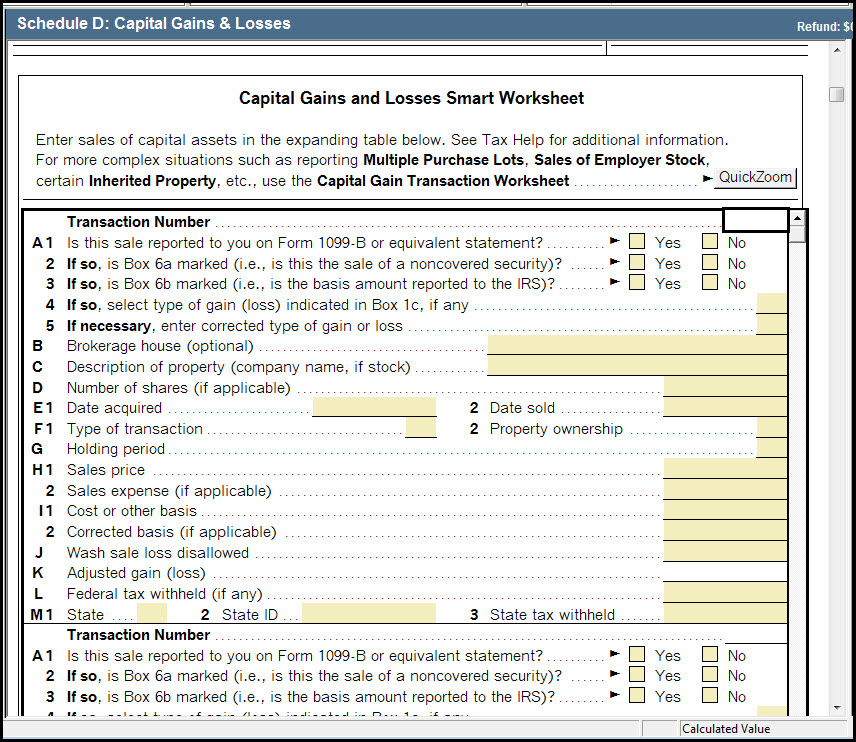

To figure out the size of your capital gains, you need to know your basis. How much you owe in taxes - your tax liability - stems from the difference between the sale price of your asset and the basis you have in that asset. Record each sale, and calculate your hold time, basis, and gain or loss. Next, figure your net capital gains using Schedule D of IRS Form 1040. Then copy the results to your tax return on Form 1040 to figure your overall tax rate. To calculate and report sales that resulted in capital gains or losses, start with IRS Form 8949.

No comments:

Post a Comment